Satellite Procurement Vehicle Progresses

|

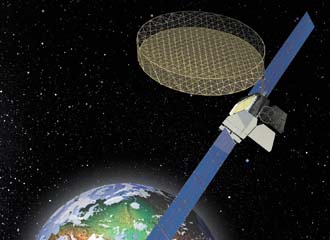

Many military and civilian federal agencies rely on commercial satellite services to carry out operations. The FCSA will enable these organizations to procure their services through the GSA, but even after the award of the first contracts, the program is proving contentious. |

The General Services Administration and the Defense Information Systems Agency have made the first contract awards under their combined commercial satellite communications program, and more are expected soon. Part of an effort that began approximately two years ago, the deals mark a major shift in the way federal government organizations procure these space-based services. And though industry has its doubts about this new arrangement, the agencies in charge of the program believe the plan will benefit users and providers alike.

Dubbed the Future COMSATCOM [commercial satellite communications] Services Acquisition (FCSA), the effort centralizes the purchase of commercial satellite communications for civilian and military agencies. Instead of groups putting out their own requests for proposals, they can all go through the General Services Administration (GSA) to place their task orders under larger contract vehicles. The GSA and the Defense Information Systems Agency (DISA) will vet all the companies offering their services and put them under the umbrella contracts before industry members can bid on specific work (SIGNAL Magazine, April 2010).

The FCSA covers three service areas: transponded capacity, subscription services and end-to-end solutions. The first two fall under new special item numbers (SINs)—132-54 Transponded Capacity and 132-55 Subscription Services—that have been created under GSA Schedule 70. At the time of publication, five companies already had received approval for inclusion on the contract vehicle for the SINs. Artel Incorporated was the first on the bandwagon with consent granted in August last year. Segovia Global IP Solutions won permission to compete soon after, and CapRock Communications Incorporated, Hughes Network Systems LLC and Intelsat General Corporation round out the group. Kevin Gallo, the GSA FCSA program manager, explains that more contracts will be awarded and that his office is “receiving proposals all the time.”

Dan Gager, DISA’s FCSA program manager, explains that services offered through the acquisition vehicle eventually should replace those currently available through DISA’s Defense Information Systems Network (DISN) Satellite Transmission Services-Global (DSTS-G), which expires in 2013. Gager says that despite the change, military SATCOM users will see no difference. “Service to the warfighter will be the same,” he states.

He also emphasizes that the ordering process will not change, but that troops will have more solutions and technologies available to them than they had under the DSTS-G. In addition, National Guard units can use the FCSA for their needs. This allows DISA to pull more Guard requirements under its procurement umbrella.

The first awards on the Schedule 70 contract vehicle were made five months ahead of schedule; FCSA program officials had planned to hand them out in fiscal year 2011. The quick releases came despite later proposal submittals by private industry than the government anticipated. Gager explains that the team made these contracts a priority to award them early.

Because the Schedule 70 vehicle is open, vendors can submit their offers whenever they are ready, and officials can review them as they come in. Gallo explains that the process allowed the team to move out the initial awards ahead of schedules. “[When] a very solid offer comes through the door, we’re able to turn it around quickly,” he says. The program office looks at the technical aspects of the contracts to ensure the selection of qualified vendors. Gallo says the FCSA is pleased with the Schedule 70 progress so far. It represents a change from the way the government ordered SATCOM services in the past, and it allows back and forth between the public and private sectors.

With five companies now eligible to bid under the Schedule 70 SINs, the quota for opening up competition on task orders has been met. DISA and GSA officials say they will begin using Schedule 70 immediately for customer task orders that fall into the scope of the Transponded Capacity and Subscription Services SINs. However, at the time of publication, no task orders had been awarded. All task orders that do not fall into the scope of the numbers will be put on to the DSTS-G bridge contract or SATCOM II contract until the end-to-end solutions contracts are available.

Under the contract vehicle, the process for military companies ordering COMSATCOM services will remain unchanged. Customers will continue to work with their

On the civilian side, the GSA says it will continue to provide the same level of support to customers with the development of requirements and selection of contract vehicle, when requested, as it does under SATCOM-II. For the COMSATCOM SINs, agencies may use any of the tools and mechanisms available to purchase services on GSA Schedules, such as e-Buy and GSA Advantage.

To meet the requirements of the end-to-end solutions portion of the FCSA, the government created two indefinite delivery/indefinite quantity (ID/IQ) contract vehicles. The first, Custom SATCOM Solutions (CS2), is a full and open competition. The second, CS2 Small Business, is a small business set aside. Deadlines for these proposals expired last year. The government now is in source selection and expects to make awards in the fourth quarter of fiscal year 2011.

DISA and the GSA expect the FCSA to benefit customers and say it particularly will enhance information assurance (IA). Under the program, the government helps industry ensure comprehension of IA requirements, and industry partners demonstrate how they can comply with the standards now or how they will comply before accepting task orders. When companies submit proposals, they fill out an IA checklist based on National Institute of Standards and Technology 800-53 and DOD Instruction 8500.2 controls. If private-sector parties have questions or appear to have misunderstandings, Gallo says the GSA sends the checklist back to make sure they do understand. “[It] helps industry get poised to meet military and civilian needs,” he says.

Gager states that he is surprised how seriously industry is taking IA requirements, going in depth about how they can meet them. “I think [the] FCSA will be a front-runner in enforcing these requirements,” he states. The effort does not introduce any standards but will improve enforcement of existing ones.

According to Gallo, the new acquisition processes create easy-to-use platforms that enable various government organizations to go straight to vendors to obtain what they need. It also gives the GSA a chance to assist agencies. “If they need more information, we’re available to help,” he explains. In cases where military groups might want to procure their solutions through another mechanism, DISA will grant a waiver that allows them to find the right contract vehicle to meet their needs.

Now that several Schedule 70 contracts have been awarded and the end-to-end solutions contracts are in the approval process, the FCSA team hopes that some of the unrest in industry over the revamped acquisitions has been resolved. Gager says that industry days helped explain the program to the private sector. “I think there were misconceptions at first,” he says. CapRock and Artel are both vendors under the DSTS-G and have embraced the new vehicle and been aggressive in competing for FCSA contracts, he explains. “I think this is the right way to go,” Gager states, adding that it helps the U.S. Defense Department act as a good steward of government money.

However, industry is not yet appeased. Skot Butler, director of strategic initiatives at Intelsat General, says the jury is still out regarding the FCSA and that he remains skeptical of the implementation of the program, but he is impressed that the government agencies involved are meeting their deadlines. “The government’s been really good about hitting their milestones since announcing this strategy,”

Intelsat General had a Schedule 70 agreement before the FCSA strategy and submitted a modification of that based on the new structure and the new numbers to win its authority to bid on task orders under the new SINs. The company also is involved in DSTS-G through the selling of satellite capacity and other services through prime contractors in the program.

He also says that industry will be watching closely to see how these contract vehicles work for the government’s procurement of COMSATCOM services. The demands of clients could affect how and even if companies that are awarded spots on the Schedule 70 and ID/IQ contracts bid. “DISA’s customers are going to have a low tolerance for low performance,” he states.

Rebecca Cowen-Hirsch, president of Inmarsat Government Services Incorporated and a former DISA executive, agrees and has serious concerns about whether warfighters can obtain the services they need through the FCSA. Because the Schedule 70s have an evergreen clause that allows people to submit proposals over the lifetime of the contract vehicles, the number of bidders for each task number could be high.

Cowen-Hirsch explains that discriminating meaningfully among the offers is not an easy thing to do and takes time. To review the proposals fairly and equitably requires due diligence, skill and subject matter expertise. She says there is a very real concern that with too many people bidding for task orders, troops may not receive necessary satellite technologies in a reasonable period. Another area of doubt she has is whether people with the right skill sets will review proposals for the best value to ensure that warfighters receive not simply the least expensive solution but that they gain the operational capabilities they need. Though this is a worry under both types of contracts, the Schedule 70s could be particularly problematic.

And the potential trouble extends beyond the military. Several civilian agencies, including the Federal Emergency Management Agency, depend on COMSATCOM for critical requirements. Cowen-Hirsch says understanding the FCSA will be important for them to gain access to what they need. She believes there is still some confusion about how the FCSA family will be used to award contracts and whether or not it can be used efficiently and cost effectively to meet the requirements of end users. Cowen-Hirsch states that the first industry days offered good exposure to what the government was thinking about the FCSA, but did little to provide any real clarity.

As does

WEB RESOURCES

FCSA: www.gsa.gov/portal/content/105299

DSTS-G: www.ditco.disa.mil/HQ/contracts/dstsgchar.asp

Intelsat General Corporation: www.intelsatgeneral.com

IGSI: www.inmarsat.com/Services/Government

Comments