Accelerating Defense: Europe and Ukraine’s Tortoise-and-Hare Innovation

European countries are building an integrated defense industrial base, crossing borders and regulatory boundaries in the continent.

“Between the United States and the European investment communities, I would say that there’s a strong degree of similarity in their views,” said Tom Driscoll, co-founder and chief technology officer of Echodyne, a defense startup with investors from across NATO.

Funds have shifted toward defense as European countries saw the destruction Russia left in Ukraine. This conflict prompted changes in the European and Western defense industrial base.

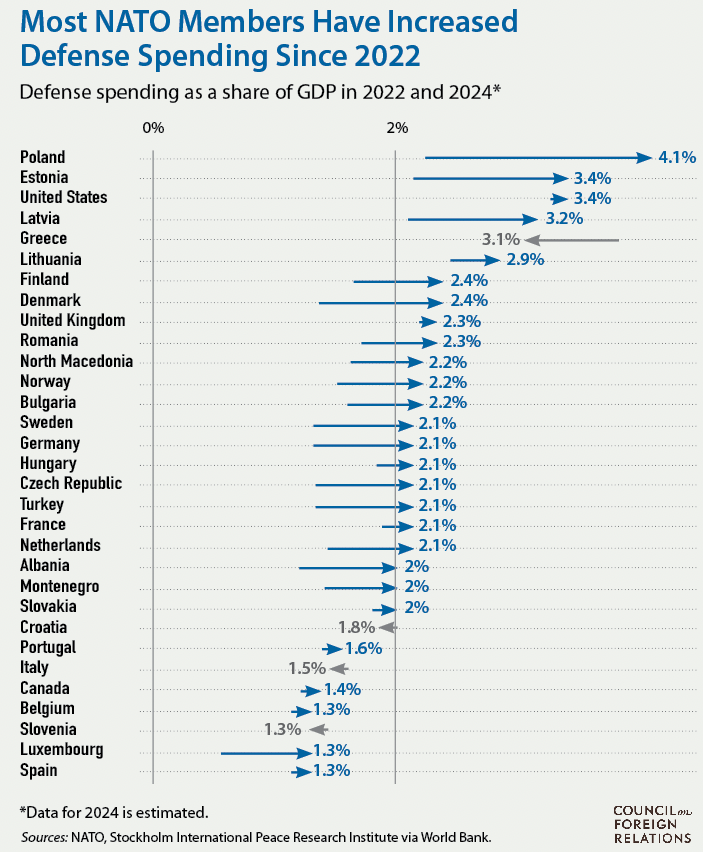

Between 2022 and 2024, all but three European NATO members increased their defense spending, with Poland leading increases to 4.12% of gross domestic product, followed by Estonia with an estimated expenditure of 3.43%, which is on a par with the United States, according to figures compiled by NATO.

On February 24, 2022, Russia initiated its full-scale attack against its neighbor, generating ripples across the world, including the defense markets. At first, Ukraine called for help from entrepreneurs and innovators around the world. “Some of the efforts that the Ukrainian Ministry of Digital Transformation has made, including overseas hackathons and outreach to Western Europe and the United States, have been successful in a call-to-action to produce more technology that the Ukrainian General Staff deems appropriate for the conflict,” explained James Acuna, founder of the Baltic Ghost Wing Center of Excellence, an unmanned vehicle training center based in Estonia, collaborating with various stakeholders in the ongoing Ukraine conflict.

Acuna’s business deals with innovators, technology startups and drone operators from Ukraine and NATO. While Ukraine sprints to bring innovations to the battlefield, Europe inches forward along the same path. With an eye on economic sustainability, the continent strives to develop a diverse defense industry.

Still, a mosaic of regulatory environments across jurisdictions is a blessing and curse as investors look for businesses that can bring their capabilities to market.

“There are many different countries in Europe, and they each have their own sets of rules and speeds and policies and procurement authorities, and that presents an opportunity oftentimes to move more quickly, especially in an environment where there is a perceived and—I believe—real critical defense capability gap. We’ve seen that many times, those European and NATO countries are able to move more quickly than the United States,” Driscoll asserted. Exploring the possible causes of these different adoption tempos, Driscoll offered that legal frameworks, procurement procedures and proximity to perceived security threats all play a role.

For Ukraine, these frameworks are less relevant. Performance is the only factor that makes a difference in a place where yards along the front lines could be heavily disputed.

And the technology of choice, unmanned aircraft systems (UAS) or drones, have disrupted warfare, especially since their wide employment in the war in Ukraine.

“Producing four thousand [first person view] 7-inch drones at €50 each, that is an achievable goal that could particularly be requested by the Ukrainians,” Acuna said.

The realities from the trenches demand quantity and performance in a resource-hungry market over exquisite capabilities.

“The goals are different than what you would find, say, in a typical venture capitalist, or private equity, or somebody that wants to see a company succeed with general customers, with military customers, etcetera,” Acuna explained.

Still, UAS use in Ukraine has created a global scramble for products, technologies and talent.

“There are fast and slow opportunities in NATO as well. We’ve seen some countries move very rapidly to shore up and bolster air defense and counter-UAS capability. At the same time, we also find that some of these standard European rules and regulations regarding entry to market, like requirements on having CE [European Conformity] mark and all these certifications and qualifications therein, are a barrier to moving quickly,” Driscoll said.

Investing is risky. But current market conditions allow those managing capital to mitigate uncertainties.

“We’re seeing investable high-growth in [enterprise vulnerability remediation] startups that are peer defense-tech, but any investor looking to hedge that bet a little bit would naturally consider the sort of safer overlap ground of dual-use,” Driscoll said.

Dual-use technologies, innovations that can be used for both civilian and military applications, have a special place in NATO and Europe.

The alliance has launched its Defense Innovation Accelerator for the North Atlantic (DIANA). This is an initiative designed to accelerate innovation, specifically in dual-use technologies.

It works by collaborating with researchers, entrepreneurs and startups across the alliance to develop innovations that address critical challenges. DIANA focuses on emerging and disruptive technologies such as artificial intelligence, quantum technologies, biotechnology, hypersonic systems, novel materials and next-generation communication networks.

About a year ago, 1,300 startups competed for $100,000 in initial funding; of those, 44 were chosen and started a business acceleration program. The subsequent stage saw the elimination of three-fourths of these, leaving only a handful of projects as recipients of the next tranche of $300,000, according to Francesca Tortorella, innovation officer at DIANA.

In 2025, DIANA expects to hold 10 challenges yearly, offering funding opportunities for attractive projects from all NATO countries, according to Tortorella.

Another source of public funding with a keen eye for dual use is the European Defence Fund (EDF).

In particular, the EU Defence Innovation Scheme (EUDIS), a part of the EDF, provides funding and support to lower entry barriers for smaller or nontraditional market players and to support innovators throughout their development cycles.

Separately, the European Investment Fund, through the Defence Equity Facility, invests in venture capital and private equity funds targeting companies that develop cross-domain capabilities.

Thus, Europe has governmental initiatives to foster its dual capability development as well as its defense investment ecosystem. These initiatives have risen after the 2022 full-scale invasion of Ukraine.

In the United States, there is a changing attitude toward defense investment, and this places the country in a position of privilege compared with allies.

“Defense tech was largely a low-margin, slow-growth business and not one that a venture capitalist would invest in, certainly not in early stages; in the United States, I think that that sentiment among investors is starting to change,” Driscoll told SIGNAL Media in an interview.

The United States runs a mosaic of small and larger programs to provide initial investments to higher risk startups not yet attractive to private investors.

“We are starting to see more programs like the [Defense Innovation Unit] that are pushing to have a faster development cycle, smaller deployments, less of this multi-decade mindset,” Driscoll explained.

Nevertheless, small capability developers face the challenges of scaling their offerings across services and alliances, which may prove to be the next challenge after startups receive funding and approval from customers.

“The gap between a prototype and supplying hundreds of millions of dollars of product is, I think, still difficult to find sources for that within government both here in the United States as well as in Europe,” Driscoll said.

The next step in the development of a European defense ecosystem, getting these startups to scale, will be the next challenge for planners and investors.

Comments