Software Reshapes 3-D Metal Printing

Melding materials three-dimensionally into state-of-the-art antennas would not be possible without key software platforms. For this, antenna producer Optisys relies on technology from ANSYS Incorporated.

Melding materials three-dimensionally into state-of-the-art antennas would not be possible without key software platforms. For this, antenna producer Optisys relies on technology from ANSYS Incorporated. Started in 1970 as a small company in Elizabeth, Pennsylvania, ANSYS now has 75 offices in 40 countries. As a multiphysics business, ANSYS looks at all aspects of physics design—structural, thermal, fluid dynamics and electronics.

The ANSYS product Optisys employs, in particular, is its High Frequency Solid State (HFSS) software. Optisys uses the electromagnetic field design software, among other ANSYS tools, to create waveguides and antenna arrays. “These antennas can be very complex structures [that] are difficult to manufacture and design,” says Steve Pilz, lead product manager at ANSYS and an expert in additive manufacturing.

“What Optisys is doing in the forefront of early 3-D metal printing is to produce these waveguides,” Pilz points out. “Since their antenna or radio-frequency products are part of phased antenna arrays in fighter aircraft, they need to be lightweight and extremely durable. They need to withstand heat, high gravitational forces, acceleration and be impact resistant. We call those conflicting demands.”

Usually in manufacturing, when a customer wants something strong, it is big and heavy. “But when it is big and heavy and strong, you can’t fly it,” Pilz laments. “We want things light, strong and durable.” These demands make the aerospace industry a natural fit for additive manufacturing, he adds. The industry is the largest customer base for ANSYS.

Harnessing 3-D printing offers Optisys crucial size and weight efficiencies. “A pound of material costs a certain amount of money—$55,000—to get into space,” Pilz says. “So if you can make that weigh half as much, you can double your payload and increase your efficiencies.”

Designers at Optisys come up with an antenna or a radio-frequency concept and then digitally simulate the design using the HFSS. The software shows how energy would move across the part—revealing the energy density or electromagnetic flux—and exposes the so-called hot spots where energy scatters or is inefficient. “In the output of the antenna, you want a more uniform electromagnetic field across the waveguide,” Pilz explains. “If the designers can give that waveguide a constrained distance and shape but give it enough distance or barrel length, it will come out with a nice tunable signal at the end of it.”

ANSYS products help Optisys understand “what the physics should look like and what the parts should look like to make the physics do those things,” Pilz explains. “We call it physics-driven design.” Optisys can go through a number of design ideas before it ever makes a part, Pilz notes. And the results can be unique forms. “They come up with these designs, and the beauty of that process is that they can design without being concerned about the shape.”

In the past, antenna designers had to be attentive to the shapes they could produce, and that limited their design possibilities. They could only produce designs that could be machined, drilled or casted. “But with 3-D metal printing, you can almost print anything,” Pilz proclaims. “Really any shape you can conceive of, you can print.”

The 3-D printing process gives antenna and radio-frequency designers incredible freedom to come up with designs that are attuned to electromagnetic performance, Pilz continues. “If we are not constrained by the things we can produce, we can create shapes that have never been seen before,” he emphasizes. And Optisys has designs that have never before been on the market. “It’s bizarre,” he says. “It’s a shape that I would never have conceived of on my own as an engineer, but we can make it now with 3-D printing.”

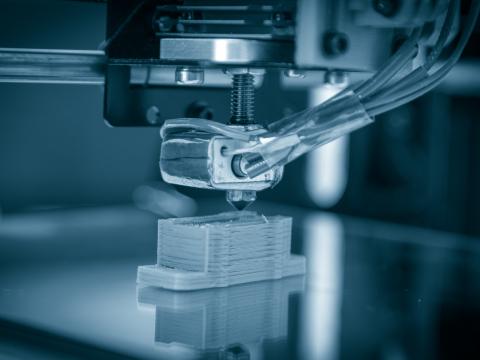

Another important function of the software tools is to simulate the 3-D printing process—including thermal and structural simulation of the product. “We start with the thermal, and in the simulation, we build the product up layer by layer and look at the heat that is contained in each layer,” Pilz notes. “From that heat signature and thermal history, we can calculate what kind of deformations or residual stresses are going to be in the build plate, or bottom, and in the part itself.”

As a product is printed, essentially through a welding process layer by layer, deformations and stresses can build up. “If it doesn’t build correctly, it can warp or twist off of the build plate,” Pilz warns. When a product is cooling after printing, it also can crack. The process simulation sees beforehand what the heat from the welding process will do, what the stresses are and where the product could crack, warp or fail. Then, customers see redesign recommendations. “The key is to get the machines to produce what they want,” Pilz says.

Customers have driven ANSYS to make this process simulation software. “They needed a prediction of what was going to happen before they went and spent $1,000 an hour to use the 3-D printer,” Pilz shares. The printers themselves, for metal applications, can cost upward of a million dollars each, he estimates. “Customers said, ‘We need you to simulate the manufacturing process itself because it is too expensive for us to fail.’ It can’t take five iterations to print the product,” he relates.

In addition to the aerospace industry, other industries are using additive manufacturing. The biomedical industry prints prostheses or other medical devices, while the power generation industry uses it to produce parts needed for fluid dynamics, injectors and nozzles. “We have one customer that produced a fuel nozzle for a turbine, which previously contained 22 separate parts,” Pilz shares. “They redesigned it to create one single part and increased its efficiency by 15 percent. It is saving the company $1 million a year in fuel.”

Comments