Blockchain, Web3 and the Prospects for Safe Digital Governance

I've had the privilege of serving in assignments that allowed me to see firsthand how government technology has transformed over the last 20 years. What is evident from early IT modernization initiatives to zero-trust adoption plans is that the world does not pause for the government to catch up. Besides, Web3, the next version of the internet—and the wave of the future—has already started breaking, introducing us to a new realm of digital ownership, trust and engagement. But what, then, is Web3 in reality? Why would federal, state and local leaders be concerned about digital currency, blockchain or decentralized identity? And how do they connect with the requirements for citizen service delivery, zero-trust architecture (ZTA) and cybersecurity? Let's take a look step by step, practically and personally.

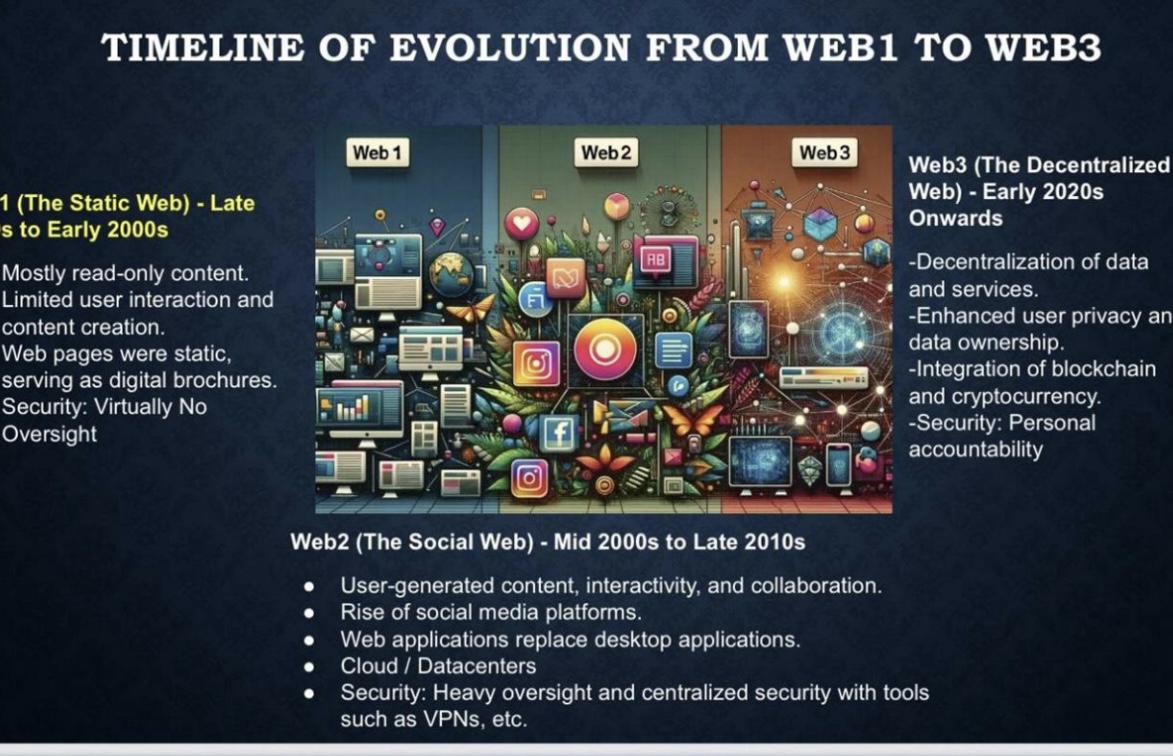

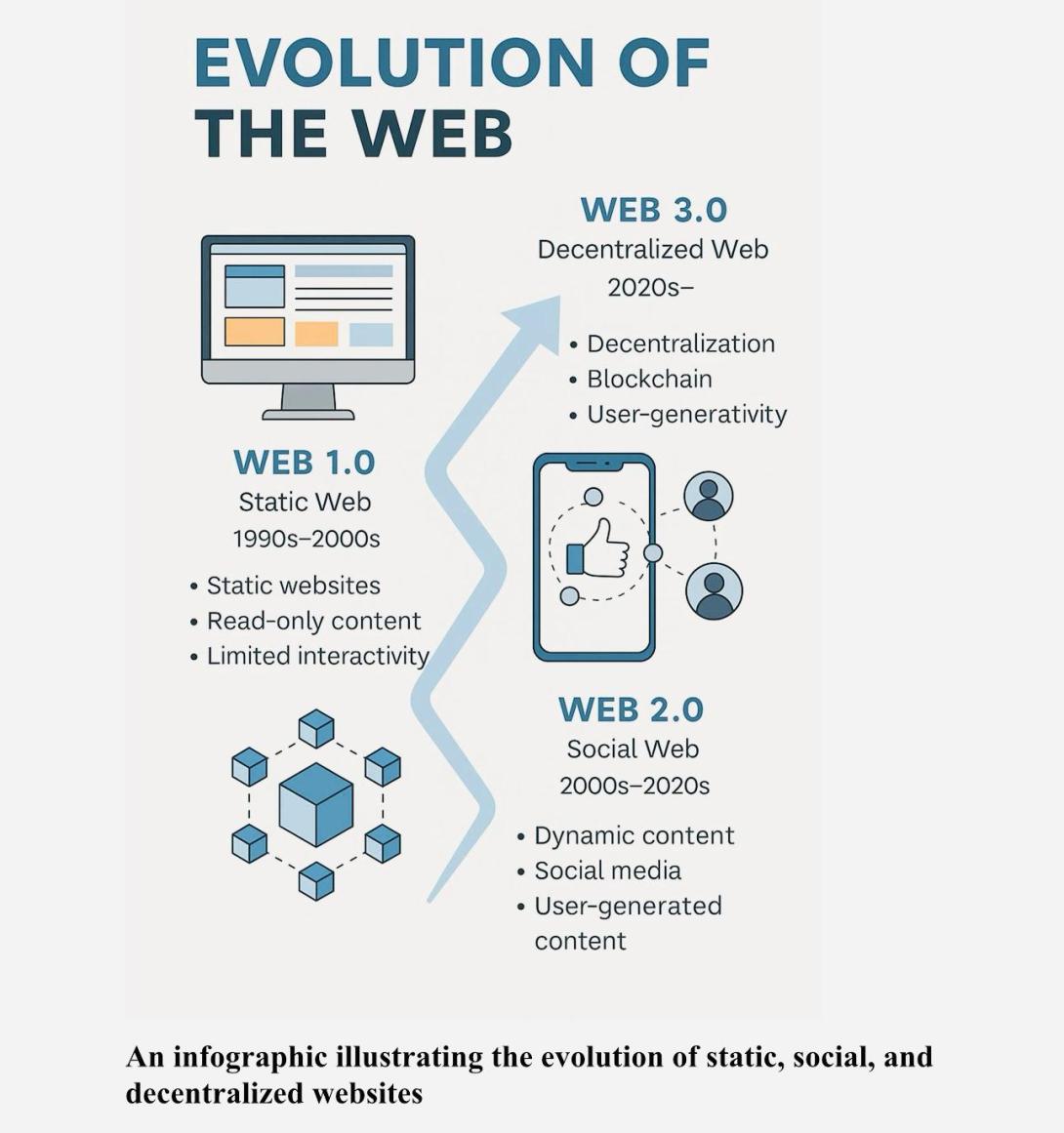

If we are to grasp Web3, let us first find out about our own past. There was a "read-only" web, or Web1, extending from the 1990s to the early 2000s and consisting mainly of static websites, electronic brochures and simple sharing of information. It was uninteractive and provided virtually no security or control over user identity. It was used mainly by government agencies to provide basic public information. Web2 (2000s to 2020s) is the period when the "social web" made its entry. Here, the citizens were able to use cloud-hosted applications to govern services, create content and engage with other people on social networking platforms like Facebook, YouTube and Twitter. It brought in vulnerability, where identification of users and privacy were omitted, and data centralization, where several big corporations had huge personal data. Virtual private networks, firewalls and endpoint detection are security options by default now.

Once again, Web3 (2020s and onwards) shifts the paradigm. We are now talking about a decentralized web where users control their data and identities. Transactions, identity proofing and governance are all enabled by blockchain technology. Data is spread and verified using consensus models instead of being stored in one place. The ZTA concepts that most agencies are looking to implement are actually in line with this by design.

This new foundation of cybersecurity is based on the assumption that no user or system should ever be trusted by default. Authentication never stops. Access is restricted. Monitoring is constant. Now observe how these principles are inherently enabled by Web3 and by blockchain, an immutable ledger. Transactions and modifications are stored permanently. Individuals are accountable for their own digital identity credentials, which can be verified without a central issuer, thanks to decentralized identity.

While others still see Web3 as a theory, we are seeing real-world applications in the government, with organizations from all over the United States implementing digital advancements. The Department of Homeland Security is investing in decentralized identity to speed up security and immigration screenings. Blockchain voting for overseas troops was piloted in West Virginia. The General Services Administration and NASA are studying the use of smart contracts in procurement and grant management. California and Illinois, among other state motor vehicle departments, are trialing blockchain-based digital driver's licenses.

What is evident from early IT modernization initiatives to zero-trust adoption plans is that the world does not pause for the government to catch up. Besides, Web3—the wave of the future—has already started breaking, introducing us to a new realm of digital ownership, trust and engagement.

For government acquisition, especially, smart contracts offer trustworthy processes and programmatic logic that enforce automatic conditions—perfect for administering awards and solicitation notices. In today's cyber threat landscape, these capabilities are necessary because they minimize risk, eliminate intermediaries and enable open audit trails.

Additionally, local housing authorities are exploring smart contract-based rental subsidies. All of these initiatives foretell a future in which government services—particularly in high-risk, high-touch programs—will be quicker, more secure and more transparent.

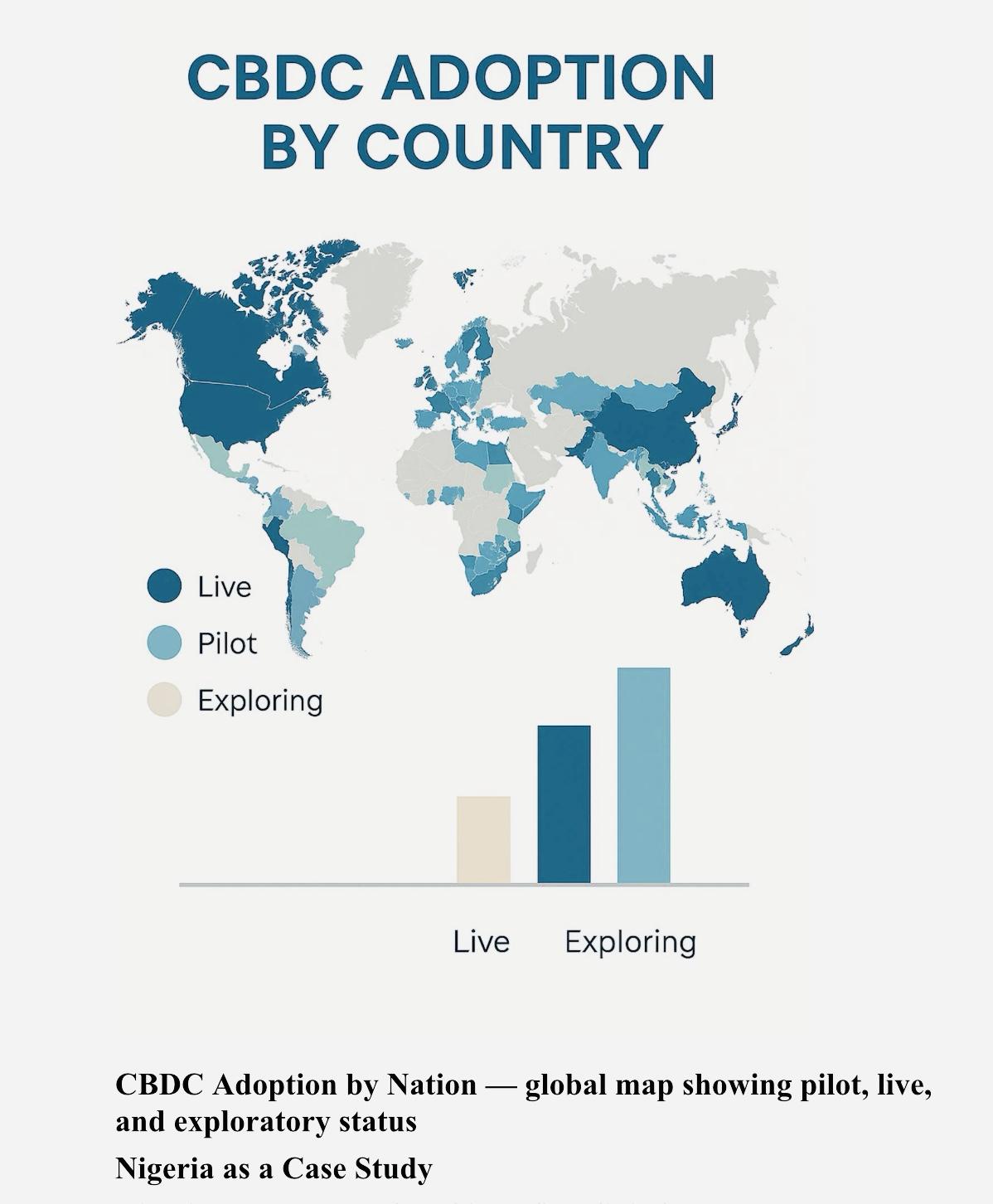

This digital age also brings into possibility the role of digital money and central bank digital currencies (CBDCs), which are growing to become integral to Web3's global economic infrastructure. CBDCs, which are digital currencies issued by governments and backed by national banks, are being adopted around the world, in various forms, including pilot stage, live and exploratory.

For example, Nigeria has created the African continent's first digital currency, the eNaira. The Central Bank of Nigeria launched it with the aim of fostering financial inclusion, lowering cash management costs and giving citizens easier access to economic services and government disbursements. The United States' own case study is Project Hamilton, which is a collaborative effort between the Massachusetts Institute of Technology and the Federal Reserve Bank of Boston to investigate the possibility of utilizing a digital dollar. The research has already shown methods by which a CBDC could facilitate federal payments, such as Social Security, tax refunds or disaster relief, to be more efficient, even with privacy and legal concerns.

Meanwhile, many U.S. agencies still employ antiquated systems that are 20 years old, full of blind spots and technical debt. With resilience, identification and privacy at its core, Web3 is an opportunity to rebuild with more intelligence.

From a static, read-only Internet to a sophisticated platform, the future of the third evolution, or Web3, of the Internet will bring together blockchain, cryptocurrency, decentralized data and services. Credit: Tarrazzia Martin; ChatGPT

We are at a fork in the road, if I have a say as an experienced professional who has navigated federal IT deployment, digital changes and law enforcement infrastructure. Although Web3 will not wave a magic wand and fix all of the problems that we have, it introduces much-needed functionality, particularly when combined with contemporary identity constructs and zero trust.

We need to be bold about leading in the following ways:

● Investing in pilot projects to experiment with decentralized tools.

● Rebranding procurement terminology to incorporate identity-led models and smart contracts.

● Training workers on emerging technology.

● Keeping the future digital citizen in mind while developing policies.

● Exploring and aligning our global thinking around the use of artificial intelligence (AI) strategies that leverage large language model approaches to catapult blockchain, Web3 and digital currency opportunities. Collectively, these technologies are the levers of revolutionary change.

The vision is ours. The architecture is ours. We even have real-life, proven examples. We must have the will to lead, not follow. Let's prepare ourselves for it, instead of waiting for a disruption to force us into action.

Tarrazzia Martin is a digital technologist, innovative activist, community leader and entrepreneur.

Central Bank Digital Currencies, or CBDCs, are growing to become integral to Web3's global economic infrastructure. Credit: Tarrazzia Martin; ChatGPT

Comments