Domestic Battery Manufacturing: The DOE’s Race for Power

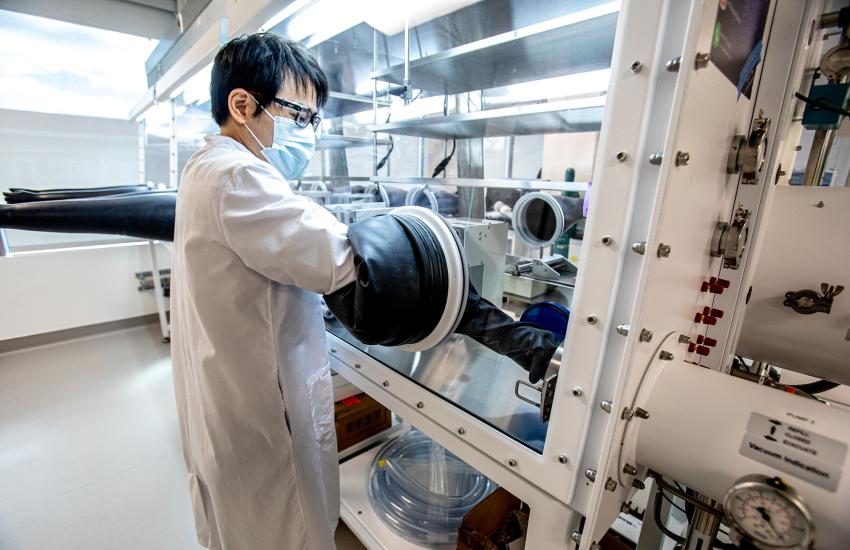

In an effort to strengthen the nation’s critical infrastructure, the Department of Energy (DOE) has been challenged to boost and secure domestic battery manufacturing.

“Certainly, relying on trade partners and our allies is a good way to go ... but we definitely have some work to do in terms of our domestic capabilities,” Steven Boyd told SIGNAL Media in an interview.

Boyd has worked for the DOE for 18 years and is currently a program manager for the agency’s Office of Manufacturing and Energy Supply Chains, which was established in February 2022.

Following President Biden’s request for an executive report on a 100-day supply chain review for critical materials and battery storage in 2020, the DOE’s Federal Consortium for Advanced Batteries (FCAB) released the National Blueprint for Lithium Batteries 2021-2030.

The report specifically identified critical areas of opportunity and was one of the first indicators of gaps in the battery supply chains and manufacturing, Boyd stated.

“We then had both the Bipartisan Infrastructure Law and then later the Inflation Reduction Act,” he stated. The legislation directed the DOE to address domestic battery manufacturing, with $6 billion allocated to strengthen the U.S. battery supply chain. This includes “producing and recycling critical minerals without new extraction or mining, and sourcing materials for domestic manufacturing,” according to the DOE.

The investment additionally supports an effort to reach net-zero emissions by 2050.

Battery use and electrification are more efficient, Boyd said, whether with cars or the grid. “You’re able to even increase the percentage of renewables on the grid.”

When it comes to global competition, it is crucial for the United States to gain momentum in operations. In May 2015, China released its own vertical battery manufacturing supply chain strategy, titled Made in China 2025. “As China and others ramp up production capacity, they stand to gain a first-mover pricing advantage from economies of scale, process learning, and control of critical inputs, impacting the competitiveness of U.S. industry,” the blueprint states.

80% of the world’s battery cells are supplied by Chinese companies, as the country retains dominance in the lithium-ion battery market, according to the Atlantic Council. Additionally, the report states, the People’s Republic of China accounts for nearly 60% of the electric vehicle (EV) battery market.

Meanwhile, the United States remains in the lead in EV sales, with over 50 million projected sales by 2040, according to the DOE blueprint.

The agency seeks to address supply chain challenges, including battery material processing, manufacturing of components within batteries, physical cell manufacturing and the recycling of those batteries and materials. “Whether it’s end-of-life or even manufactured life, it’s never 100% perfect, so even recapturing any of those materials and trying to close the loop or make it tighter or better,” Boyd explained.

The materials necessary to produce the crucial lithium-ion batteries are lithium, cobalt, nickel and graphite, most of which originate outside the United States.

Under the Bipartisan Infrastructure Law, and combined with private entities and the U.S. government, the DOE has been rolling out funding opportunities in phases.

“In the first phase, DOE awarded fifteen projects that are catalyzing over $5.8 billion in public/private investment,” a DOE representative told SIGNAL Media in an email. The projects include domestic processing and recycling of critical minerals to support domestic manufacturing.

The projects are primarily for construction, Boyd continued. Ascend Elements, representing two of the 15 selected projects and the highest funded company on the list with more than $480 million in federal shares—is working on an integrated sustainable battery active material production plant and an integrated sustainable battery precursor. A February press release states that the Ascent Elements’ Apex 1 facility will be North America’s first sustainable cathode precursor (pCAM) manufacturing facility, set to open in 2025 in Hopkinsville, Kentucky. “When complete, the 1-million-square-foot facility will produce sustainable pCAM and CAM (cathode active materials) for up to 750,000 electric vehicles per year,” the release states.

Other projects include work on cathode active minerals, lithium processing plants, U.S.-owned and operated anode supply chain for synthetic graphite and more.

Now in its second phase, the DOE announced $3.5 billion from the Bipartisan Infrastructure Law to continue investing in domestic production and operations to support the clean energy transition. The phase “prioritizes next-generation technologies and battery chemistries, in addition to lithium-based technologies,” the agency’s November release stated.

Additionally, the statement noted that the agency seeks projects to “increase the separation of battery-grade critical materials, expand production facilities for cathode and anode materials production and expand battery component manufacturing facilities.”

As full applications were due mid-March, Boyd says the next step in the process could take months. Upon the selection announcement, which is expected late summer, the agency enters negotiations for the projects. “That’s how we actually get to a contractual agreement between the government and the performing entity or party,” he said. Once those are approved, each project must go through three phases—permitting, drawings, plans. “Each [project] will have submitted their plan as part of their proposal.”

To be competitive in the battery manufacturing market, collaboration with interagencies is crucial. The FCAB involves participation among 18 federal agencies, primarily the Environmental Protection Agency, the Department of Commerce, Department of Defense and the Department of State, Boyd told SIGNAL Media.

“Many of these things take a really long-term view to mature and come to fruition,” he continued.

As battery markets continue to grow, domestic manufacturing promises significant benefits for the United States. “Economic security is a huge one,” Boyd said. From the electrification of transportation and the grid, controlling the economics of domestically made vehicles would only prove beneficial, environmentally or economically.

Comments